Fintech Startup

Built on real-world demand, not speculative hype.

CryptoFlex is more than a crypto startup — it’s an infrastructure company delivering compliant, accessible, and profitable cryptocurrency payment & exchange services in the physical world. While most crypto projects focus on token speculation, we focus on utility, regulation, and revenue.

- All logos displayed are for illustrative purposes only and remain the property of their respective owners. They are used here as examples and do not imply any affiliation or endorsement.

Join us at the forefront of real-world crypto adoption.

If you’re an investor or strategic partner looking to shape the future of digital payments, request access to our confidential materials. After submitting the form, you’ll receive a pre-filled NDA for signature. Upon completion, we’ll send you the full investor package, including our pitch deck and financials.Included Documents:

-

Business Plan

-

Pitch Deck

-

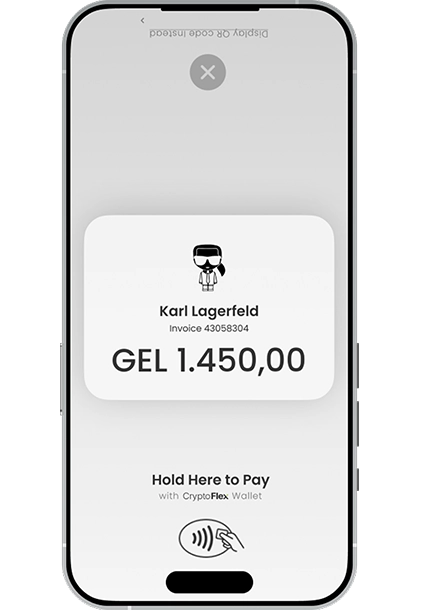

Walkthrough — CryptoFlex POS System

-

Roadmap

Download PitchDeck:

If preferred, you may also request a limited version of the pitch deck without signing an NDA by providing your email address below.

Fintech Startup

Real-world Crypto Payments as Simple and Seamless as Credit Card Payments.

CryptoFlex is more than a crypto startup — it’s an infrastructure company delivering compliant, accessible, and profitable cryptocurrency payment & exchange services in the physical world. While most crypto projects focus on token speculation, we focus on utility, regulation, and revenue.

By submitting this form, you consent to the collection and processing of your personal data by CryptoFlex for the purpose of reviewing and responding to your investment-related inquiry. All submitted data will be handled securely and in accordance with GDPR standards. Access to confidential documents, such as the business plan or investor materials, may require the prior execution of a Non-Disclosure Agreement (NDA). Please review our Privacy Policy for more details.

If you’re an investor or strategic partner looking to shape the future of digital payments, request access to our confidential materials.

After submitting the form, you’ll receive a pre-filled NDA for signature. Upon completion, we’ll send you the full investor package, including our pitch deck and financials.

Included Documents:

Business Plan

Pitch Deck

Walkthrough — CryptoFlex POS System

Roadmap

Download PitchDeck:

If preferred, you may also request a limited version of the pitch deck without signing an NDA by providing your email address below.

- All logos displayed are for illustrative purposes only and remain the property of their respective owners. They are used here as examples and do not imply any affiliation or endorsement. The documents and any detailed information are not made publicly available to avoid any implication of a public offering. This communication does not constitute, and shall not be construed as, a public offer or solicitation to invest under any applicable securities laws.

Thank you for your interest in CryptoFlex

We're excited to share our vision with you. You can download the pitch deck below:

Or open directly:

https://cloud.crypto-flex.com/download.php?id=10&token=89d4a142d762e63b93ccc07f7a86daa9

Have questions or want to speak with us directly?

Just reply to this message or reach out at

info@crypto-flex.com

— our team will be happy to assist you.

CryptoFlex LLC

Ilia Chavchavadze Str. 78-88

6010 Batumi

GE–Georgia

info@crypto-flex.com

www.crypto-flex.com

Please note:

The information provided is confidential and intended solely for the recipient. It does not constitute, and shall not be construed as, a public offering or solicitation to invest under any applicable securities laws.

CryptoFlex LLC | Registered in Georgia (Ilia Chavchavadze Str. 78-88 | 6010 Batumi) as a Legal Entity of Private Law | Company Registration Number: 445757547 | Registered with the LEPL National Agency of Public Registry.

Telegram

Telegram